Process Unstructured Data Instantly - with LLM powered Document AI

Index Documents. Extract Data. Chat with Complex Files for Instant Answers - with Generative AI & LLM based document automation.

Document AI for Mortgage, Banking & Insurance.

Data Intake to Decisioning - simpler, faster, accurate.

Vaultedge is a LLM based Document AI platform for banks, insurance & mortgage companies.

Using Vaultedge, process documents 5x faster for highly accurate underwrite & claims decisioning - powered by AI & Human in the loop.

AI that understands complex documents - like a human.

Vaultedge uses machine learning, generative AI & LLM models to understand non-standard documents, extract data and generate decisioning insights - like a human expert at work.

Private LLM for your documents - minus the data risks.

With Vaultedge Generative AI solution - ask questions off your documents, get instant human like answers with detailed explanations.

It’s like GPT for your documents - minus hallucination or data risks of Public ChatGPT.

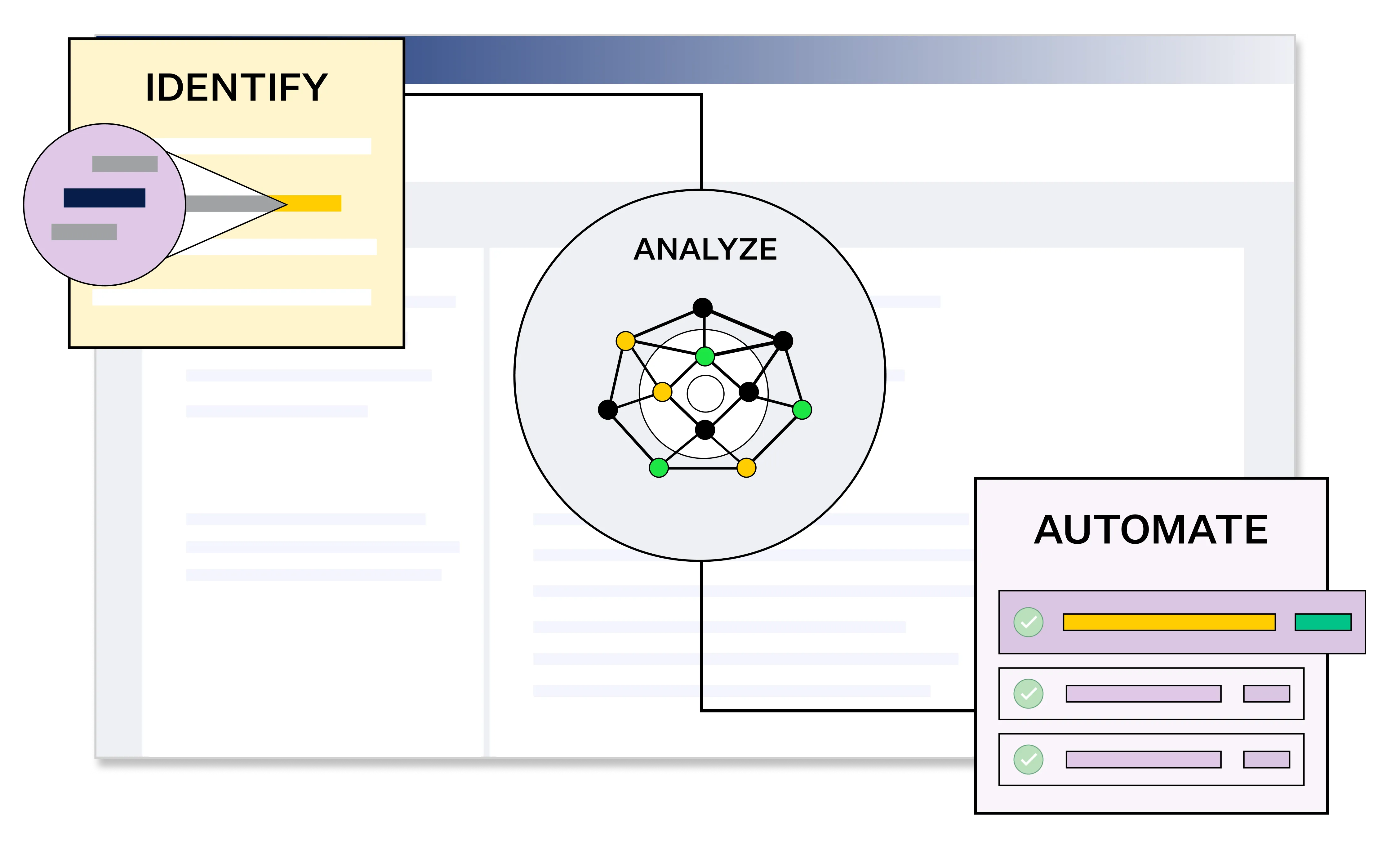

Single solution for end-to-end Document Processing Automation.

With Vaultedge ingest documents from multiple sources, classify them accurately, spot errors, extract & validate data using LLM models - all at one place.

Arrive at underwrite & claim decisioning without back & forth hassle.

Customizable. Scalable. Zero hassle integration.

Vaultedge is a workflow based solution that integrates with your record management systems to automatically key in data - once flagged exceptions are resolved.

Vaultedge can be deployed quickly and scaled easily to handle millions of documents per day - as it learns progressively with usage.

Used By The Leading Companies

Vaultedge Document AI for your use case

Vaultedge Document AI helps mortgage companies, insurers & banks automate their entire document processing lifecycle to arrive at accurate decisioning, faster.