Elevate Your Mortgage Lending with Document AI

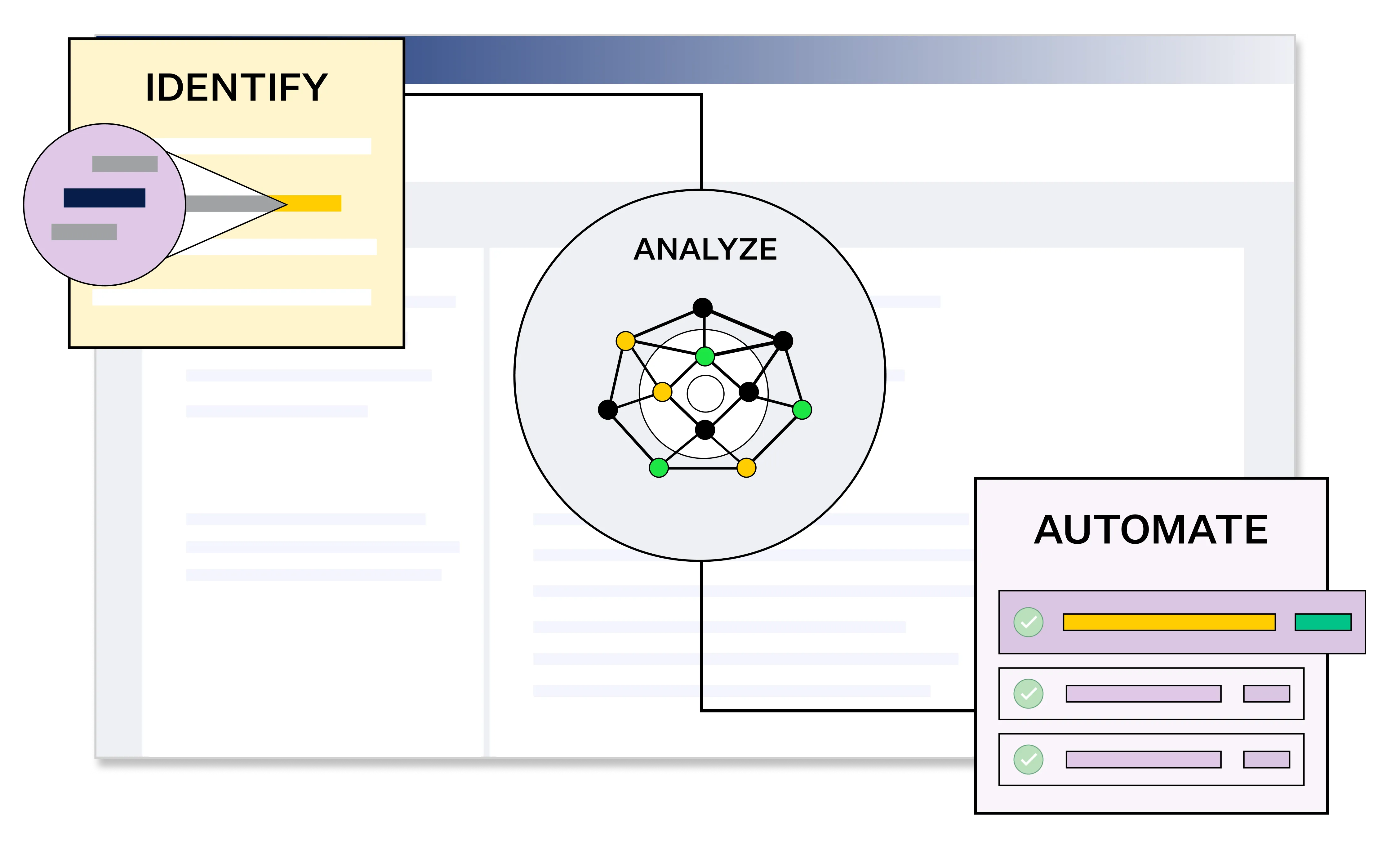

Cut costs and time in loan production, boarding, and due diligence through AI-driven automation.

Used by the

Leading companies

Core Capabilities for Unmatched Efficiency

Time and Cost Efficiency

AI-driven with an additional layer of human review for unparalleled accuracy.

Efficient Document Handling

Automate the classification of over 500 document types, from loan estimates to W-2s, with AI-driven dynamic checklists.

Robust Data Extraction

Extract and cross-verify over 2,000 data points from loan packages, eliminating manual errors and ensuring data integrity.

Seamless Software Integration

Integrate effortlessly with industry-standard software like Ellie Mae and Black Knight, maintaining workflow continuity.

Estimate Your ROI with Vaultedge Mortgage Automation

Use our ROI calculator to see how much you can save per loan and overall.

Frequently Asked Questions

VMA automates document classification, data extraction, and software integration. It can sort over 500 types of documents and extract more than 2,000 data points, streamlining the mortgage process from start to finish.

VMA can reduce your document processing costs by up to 80% and cut the loan turnaround time by 50%. It also minimizes manual data entry, thereby reducing the risk of human error.

VMA is versatile, capable of identifying and processing a wide range of documents including 1003 forms, loan estimates, W-2s, pay stubs, and more.

Yes, VMA is compliant with industry standards and can integrate seamlessly with Ellie Mae, Black Knight, and any in-house LOS through open APIs.

VMA employs advanced AI algorithms for precise data extraction and incorporates a cross-verification feature to ensure data integrity.

Absolutely. VMA offers open APIs for easy integration with leading LOS software like Ellie Mae and Black Knight, as well as custom in-house solutions.

VMA can be configured and operational in less than a week, allowing you to realize its benefits almost immediately.

With VMA, lenders have achieved a 50% reduction in turnaround time and up to an 80% reduction in document processing costs, significantly boosting ROI.

Yes, VMA incorporates a Human-in-the-Loop review process to ensure an additional layer of accuracy and compliance.

VMA employs robust data security measures to protect sensitive information, adhering to industry compliance standards.

Ready to go?

Connect with one of our solution experts to find out how Valutedge can help you increase your productivity.